CPD Training Program

Mandatory CPD Training Central Bank Program For UAE Foreign Exchanger

Governance, Risk & Compliance Excellence

48

24

100+

Apply Now

Memberships & Collaborations

Course Overview

Intensive 48-Hour CPD Program

This comprehensive Continuous Professional Development program is specifically designed to build advanced competencies in Governance, Risk, and Compliance for professionals in financial and non-financial institutions.

Our program caters to professionals in banks, insurance companies, exchange houses, and other financial institutions, equipping them with the essential tools to navigate today’s complex regulatory and operational landscape.

Through real-world case studies, expert-led sessions, and interactive discussions, participants will gain practical skills that directly enhance institutional governance and operational integrity.

Course Highlights

Schedule for First Quarter

Proliferation Financing: Risks and Global Implications

AML/CFT Typologies & Suspicious Transaction Indicators

Global Sanctions Regimes: Players & Legal Frameworks

Understanding ML/FT Risks in Financial Products & Services

Identifying PF & Sanction Exposure via CDD

ISTR, STR/SAR, Tipping Off & Record Retention

Enterprise-Wide Risk Assessments: Risk Identification & Evaluation

Trade-Based ML & PF: Risks and Implications

Developing Effective Compliance Policies & Procedures

Compliance Program & Its Pillars

Blockchain Basics & AML Risks in Crypto/FinTech

Customer Risk Assessment & KYC: Role-Based Training

Technology’s Role in Financial Crime Convergence

Ensuring Compliance Culture & Employee Risk Responsibilities

KYCC: Assessing Corporate Clients & Managing Risks

Emerging Risks in Financial Sector: ML/TF/PF Challenges

Senior Management Compliance Training

Role of Governance in AML/CFT & ESG Compliance

Identifying & Managing Risks in DPMS & DNFBPs

Anti-Bribery and Corruption

CBUAE Reporting: Regulatory Compliance & Updates

Fraud Detection

STR/SAR Reporting Mandates

Fraud Risk Management: Detecting Counterfeit Documents

Who We Are?

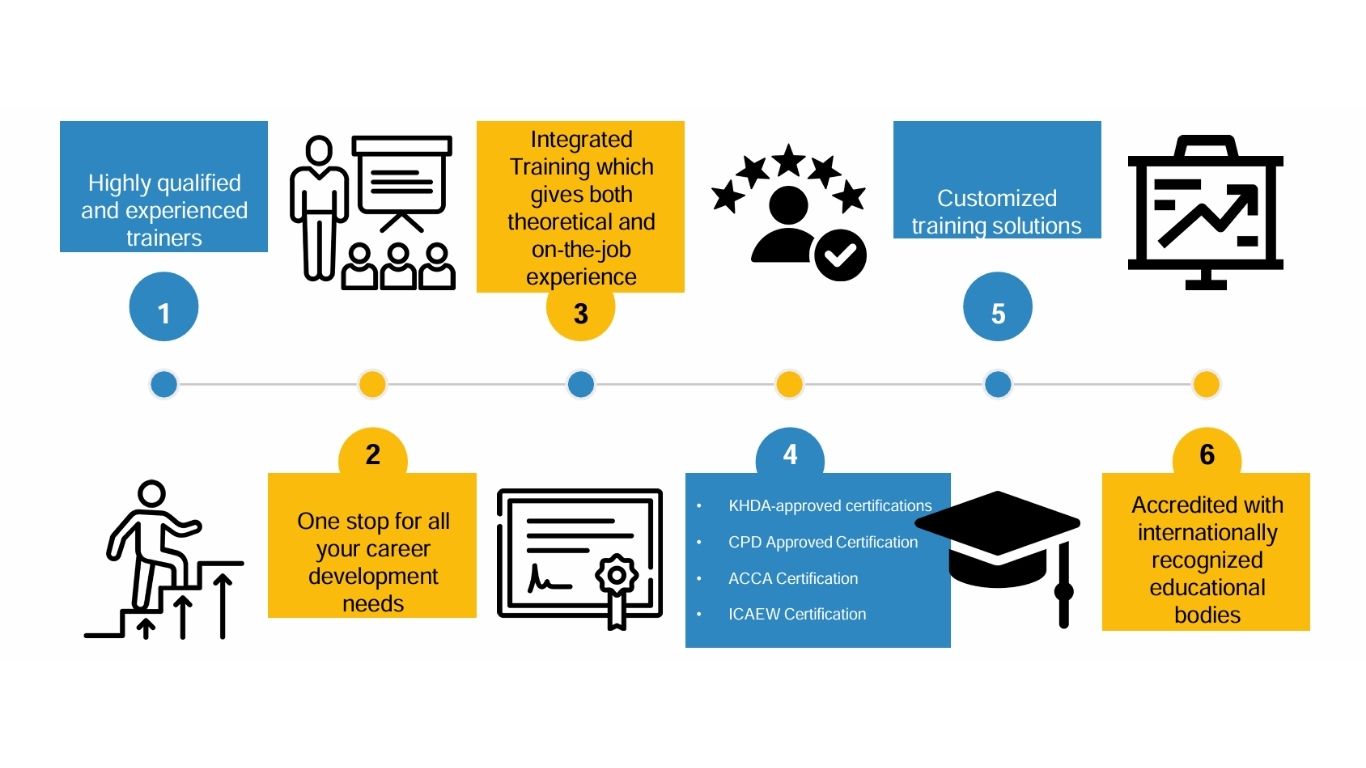

Hayford Training Institute is a premier training provider based in Dubai, UAE, recognized by leading corporations as a trusted partner for enhancing workforce capabilities through specialized certificate training. Our focus on critical service areas such as compliance, finance, banking, IT, sales, HR, ESG, supply chain, and quality management ensures that your team is equipped with the skills needed to excel in today’s competitive landscape.

Why Choose Hayford for CPD Training

Program Highlights

- 48-Hours of Expert Led Training

- CPD UK Certification

- 10+ Certified Trainers

- Each module will feature by multiple trainers, each an expert in their respective field.

- Earn a globally recognized certificate

- Fully Interactive & Live Sessions

- Work on case studies relevant to your role

Meet Our Expert Trainers

Abhishek Jajoo

Vyana Sharma

Muhammad Rizwan Khan

P. Satish Menon

10+ Certified Trainers. Each module will feature multiple trainers, each an expert in their respective field.